Homeowners Insurance and Plumbing Problems: What Issues Are Covered?

Understanding the coverage scope of your homeowners insurance in relation to plumbing issues is crucial. Often, homeowners find themselves in a gray area when it comes to insurance claims for plumbing problems. Gain some insight on what is typically covered and what isn't, helping you navigate these murky waters more effectively. Charlotte Plumbing is here to help you fix your plumbing issues and maximize your insurance benefits.

Understanding Your Homeowners Insurance Policy

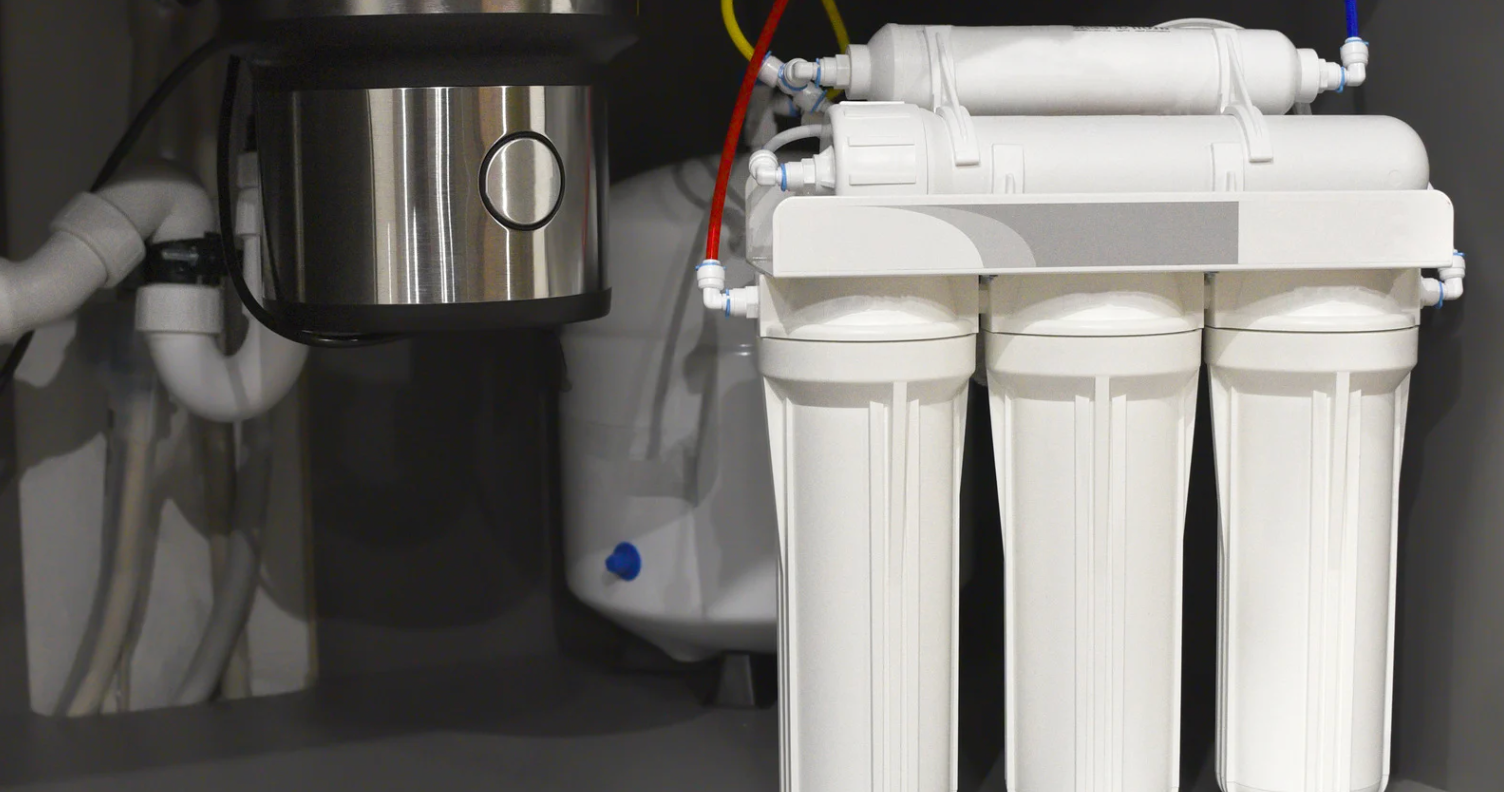

Before delving into specifics, it's essential to understand that homeowners insurance policies may vary. Generally, they are designed to cover sudden and unforeseen damages, not problems that arise from neglect or wear and tear. Commonly covered plumbing issues often (but not always) include:

- Sudden or Accidental Discharge: This includes situations like a burst pipe or a sudden malfunction of your plumbing system. If a pipe unexpectedly bursts and causes water damage, the cost of repairing the pipe and the ensuing damage is typically covered.

- Water Heater Failures: If your water heater suddenly leaks or bursts, causing damage, this is often covered. However, if the failure is due to lack of maintenance, coverage might be denied.

- Damage from Frozen Pipes: In many cases, damage from frozen and then burst pipes is covered. However, if the insurance company deems that you've been negligent in preventing pipes from freezing (like not heating your home adequately), they may not cover the damage.

- Sewer Backups (with endorsements): Standard policies usually do not cover sewer backup unless you have added a specific endorsement to your policy. If you have this endorsement, damage caused by sewer line backups is usually covered.

Plumbing Issues that Insurance Usually Doesn't Cover

As we mentioned, every insurance policy is different. However, issues not typically covered by homeowners insurance include:

- Gradual Damage: Plumbing issues that develop over time, like a slow leak, are typically not covered as they are considered a maintenance issue.

- Sewer Line Issues Outside Your Home: Standard policies generally do not cover the sewer lines outside the footprint of your home. For this, you might need additional coverage or a separate policy.

- Damage from Unresolved Maintenance Issues: If a plumbing problem arises due to lack of maintenance or neglect (like not repairing an old, corroded pipe), your insurance is unlikely to cover it.

Plumbing and Insurance Tips for Homeowners

Although there will always be some unforeseen issues, you can minimize problems, damage to your property, and policy confusion with the following tips.

- Regular Maintenance and Inspections: Regularly check your plumbing system and have professional inspections done periodically, such as the services offered by Charlotte Plumbing.

- Keep Records: Maintain records of repairs and maintenance. This documentation can be vital in making a successful insurance claim.

- Review Your Policy: Regularly review your insurance policy to understand what is covered. Consider adding endorsements if needed, especially for sewer backups.

- Preventive Measures: Take preventive measures, like insulating pipes to prevent them from freezing, to show that you've been proactive in maintaining your plumbing system.

Trust Charlotte Plumbing for Your Plumbing Problems

While homeowners insurance can provide a safety net for sudden and accidental plumbing disasters, it’s important to be proactive in maintaining your plumbing system to prevent issues that typically aren’t covered. Understanding your policy, performing regular maintenance, and taking preventive actions are key steps in protecting your home. For expert advice and regular maintenance, don’t hesitate to

contact professionals like Charlotte Plumbing.